Payment fraud has become one of the biggest challenges businesses face. Fraudsters are increasingly sophisticated in their fraud methods, causing serious damage to the revenue and reputation of organizations. However, the emergence of the Greip platform, with its advanced artificial intelligence (AI) technology, has provided an effective solution to prevent these payment frauds.

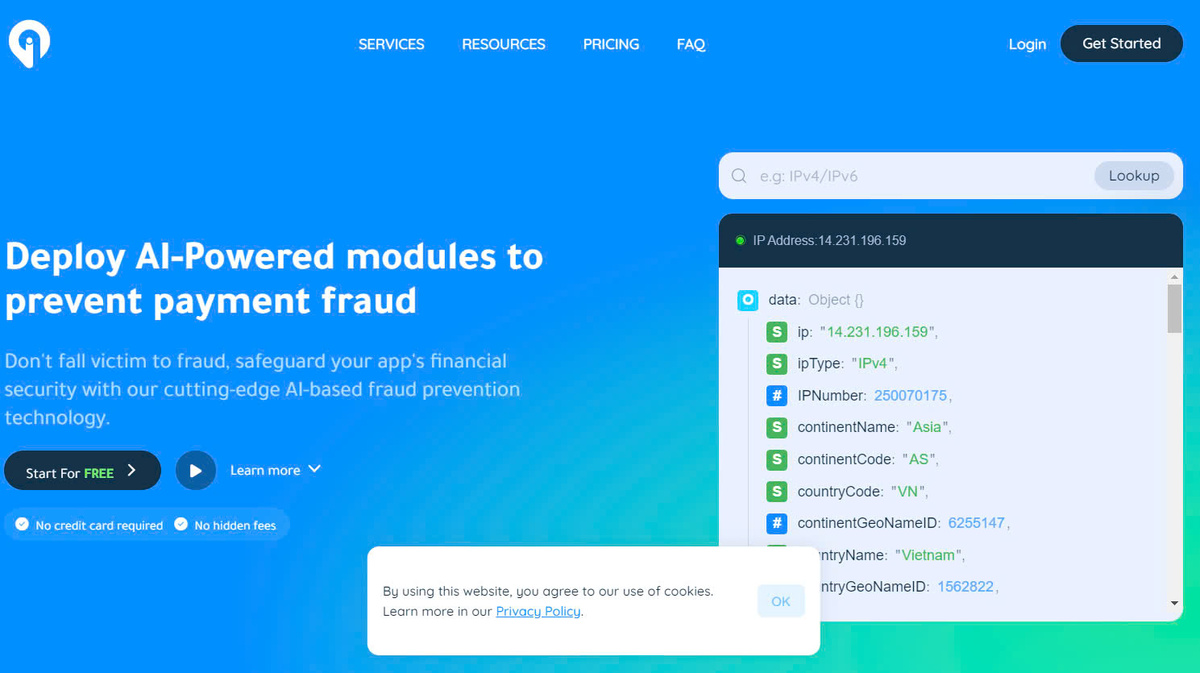

In this article, Sharehubtech introduces Greip - a SaaS (Software-as-a-Service) platform that provides AI-based payment fraud prevention modules. We will explore how Greip works, its outstanding features, and its applications in different business sectors. Let's find out how Greip can help your business protect its financial security!

I. Introduction Greip

1. What is Greip?

Greip is a SaaS (Software-as-a-Service) platform that provides payment fraud prevention modules based on artificial intelligence (AI) technology. This platform is designed to help businesses, especially those operating in the fields of e-commerce, fintech, banking and insurance, effectively prevent payment fraud.

2. Problem: Payment fraud is increasingly sophisticated

Payment fraud is an increasingly complex problem and causes serious damage to businesses. Fraudsters are constantly finding new ways to commit fraud, such as using stolen credit card information, spoofing accounts, or making fraudulent claims. Damage caused by fraud not only affects revenue, but also affects reputation and customer trust.

3. Advantages of Greip

- Advanced AI technology : Greip uses machine learning, deep learning and big data analytics techniques to detect complex fraud patterns that traditional methods cannot.

- Highly customizable : Greip's modules are designed to be flexible, easily integrating with a business's existing systems.

- High efficiency : Using Greip helps reduce fraud rates significantly, thereby saving costs for businesses.

- Easy to use : Greip has a friendly interface, easy to install and manage.

4. Suitable audience

Greip is suitable for businesses operating in the following fields:

- Ecommerce

- Fintech (financial technology)

- Bank

- Insurance

- Other industries have a high risk of payment fraud

II. How Greip Works

1. AI technology

Greip uses machine learning, deep learning and big data analytics techniques to detect payment fraud patterns. Greip's AI models are continuously trained to improve their ability to detect and prevent increasingly sophisticated fraud.

Greip's operating process is based on advanced AI technologies including:

- Machine learning : Greip uses machine learning algorithms to analyze user behavior, thereby detecting unusual transactions and potential fraud.

- Deep learning : Greip's deep neural networks are capable of automatically learning complex characteristics of transaction data, helping to improve fraud detection accuracy.

- Big data analytics : Greip processes and analyzes huge amounts of transaction data from a variety of sources, to find patterns, trends, and connections underlying fraudulent behavior.

2. Operational process

Greip's operational process to prevent payment fraud includes the following steps:

- Data Collection : Greip collects transaction data from a variety of sources, such as payment systems, customer information, and external data sources.

- Data analytics : Using AI technologies, Greip analyzes transaction data to find unusual patterns, behaviors and characteristics that may be related to fraud.

- Risk assessment : Based on analysis results, Greip evaluates the risk level of each transaction, identifying transactions with a high likelihood of being fraudulent.

- Prevent fraud : Greip rejects high-risk transactions and warns about suspicious transactions so businesses can check and handle them promptly.

This process is performed continuously, helping Greip stay updated and improve its ability to detect new fraudulent acts.

III. Greip Key Features

1. Real-time fraud detection

Greip has the ability to analyze and assess the risk of transactions as soon as they happen, helping businesses prevent fraud promptly.

| Feature | Describe |

|---|---|

| Real-time transaction analysis | Greip analyzes transactions instantly, no waiting required. |

| Assess risks immediately | Greip evaluates the risk level of each transaction and makes timely blocking decisions. |

| Suspicious transaction warning | Greip alerts businesses of transactions showing signs of fraud to check and process. |

2. Custom machine learning model

Greip allows businesses to train AI models on their own transaction data, to increase fraud detection accuracy.

- Businesses can provide historical transaction data for Greip to build a model suitable for business characteristics.

- The machine learning model is continuously updated, learning from new data to improve its ability to detect new fraud.

- Greip uses advanced machine learning and deep learning techniques to optimize models.

3. Flexible rule management

Greip allows businesses to create their own custom anti-fraud rules, giving them control and meeting their own payment security requirements.

- Businesses can easily set up rules based on criteria like transaction type, location, transaction value, etc.

- The rules can be continuously updated to accommodate new fraud situations that arise.

- Greip provides a direct interface to manage rules effectively.

4. Reporting and analysis

Greip provides detailed reports on transactions, fraudulent activity, and the effectiveness of prevention measures, giving businesses a complete picture of the fraud situation.

- The reports provide detailed information about declined transactions, reasons for decline, and suspicious transactions.

- Trend analysis helps businesses identify new threats and adjust their anti-fraud strategies accordingly.

- Businesses can customize reports and analytics to meet their unique management needs.

5. API integration

Greip is designed with flexible APIs, making it easy to integrate with payment, customer management, and other enterprise systems.

- API integration allows Greip to receive and process transaction data from other sources.

- Businesses can quickly connect Greip to payment platforms, CRM, and other systems.

- APIs are designed to comply with high security standards, ensuring the safety of business data.

IV. Greip's Application

1. E-commerce

Greip plays an important role in protecting e-commerce businesses from common forms of payment fraud, including:

- Credit card fraud : Greip detects and prevents transactions using stolen credit card information.

- Account fraud : Greip identifies unusual signs of user accounts, preventing account fraud.

- Refund Fraud : Greip detects and prevents fraudulent refund requests.

2. Fintech

Fintech companies can also use Greip to protect customers' online financial transactions from fraud.

- Online transactions : Greip monitors and detects questionable transactions in fintech applications.

- Online transfers : Greip prevents fraudulent transfers.

- E-wallets : Greip protects e-wallets from fraudulent activities targeting account balances.

3. Bank

Banks can also use Greip to prevent fraud related to credit cards, transfers and other services:

- Transfer Fraud : Greip detects and prevents invalid transfer transactions.

- ATM card fraud : Greip helps banks identify and prevent fraudulent activities related to ATM cards.

- Protecting customer information : Greip ensures the safety of bank customers' personal information and accounts.

4. Insurance

In the insurance sector, Greip can assist companies in detecting and preventing fraudulent claims:

- Fraudulent Claims : Greip analyzes claims from customers to determine authenticity.

- Detect fraud in customer records : Greip helps identify untrue information in customer records.

- Minimize risks for insurance companies : Greip helps increase information security and minimize the risk of loss due to fraud.

V. Greip Pricing Plans

Greip offers three pricing plans to suit the needs and business scale of each business: Starter, Pro and Enterprise.

1. Starter package

- Price : Low fees, suitable for small businesses.

- Number of transactions : Limit the number of transactions processed per month.

- Features : Basic features such as real-time fraud detection, basic reporting.

2. Pro Package

- Price range : Diverse, suitable for medium and large businesses.

- Number of transactions : The number of transactions processed is higher than the Starter package.

- Features : Adds features like custom machine learning models, flexible rule management.

3. Enterprise package

- Price level : High-end, for large businesses and corporations.

- Number of transactions : There is no limit to the number of transactions processed.

- Features : All the premium features like detailed reporting and analytics, full API integration.

Compare packages

| Package | Price | Number of transactions | Feature | Support |

|---|---|---|---|---|

| Starter | Short | Limit | Basic | |

| Pro | Medium | More than Starter | Advanced | Email, phone |

| Enterprise | High-class | Unlimited | Overview | 24/7 |

Endow

Currently, Greip is having attractive incentive programs for new businesses and long-term partners. For more details about these incentives, businesses can contact the Greip team directly.

BECAUSE. Greip Alternatives

In addition to Greip, there are a number of other options in the payment fraud space that businesses can consider:

1. Riskified

Riskified is an e-commerce fraud prevention platform that uses AI technology to detect and prevent fraud.

- Advantages : Effective fraud detection, easy integration with e-commerce systems.

- Disadvantages : High cost, support may not be flexible.

2. Sift

Sift is a digital risk management platform that helps businesses prevent fraud and verify customer identities.

- Advantages : Flexible integration, good protection of personal information.

- Disadvantages : Requires high technical knowledge to deploy and manage.

3. Account

Kount is a global payment security solution, helping businesses reduce the risk of fraud in online payment transactions.

- Advantages : Effective in detecting fraud, supports many payment methods.

- Disadvantages : Needs high investment costs for deployment and maintenance.

VII. Conclude

In an increasingly complex payment fraud landscape, using AI-based anti-fraud solutions like Greip not only helps businesses effectively prevent fraud but also enhances security. information and customer protection.

With the outstanding advantages of advanced AI technology, flexibility and high efficiency, Greip is the top choice for businesses operating in the fields of e-commerce, fintech, banking, insurance, and many more. other areas.

Any business interested in protecting payment and customer data, contact Greip today for advice and experience the leading payment fraud prevention solution on the market.